If the poor boy cannot come to education, education must go to him

- Swami Vivekananda

-Donations-

Annadanam Donations

The Students' Home collects donations to meet the food expenses of all students. Donors donate on the occasion of special days like birthday, wedding day, in memory of loved ones, festivals, celebrations and others ...read more

The Students' Home requests donation contibutions, sponsorships to meet the general expenses connected with providing free education, food and accommodation ...more

Endowment Donations

Endowments are created to serve a particular purpose – like Annadanam Endowment, Vidyadanam - Education Endowment or General Purpose Endowment ...read more

Vidyadanam - Educational Donation

The Students' Home needs donations for providing free education to all the students. Giving books, notebooks, other educational aids to students, meeting school and institute laboratory and workshop expenses and related expenses need donations from well wishers..read more

Capital Donations

Donations can be given to construct buildings in the Students Home, purchase furniture, laboratory and other equipment, utensils and vehicles for the Students Home and its units..read more

Other Needs

Equipment for Polytechnic College & Donations in Kind for Consumer Items..more

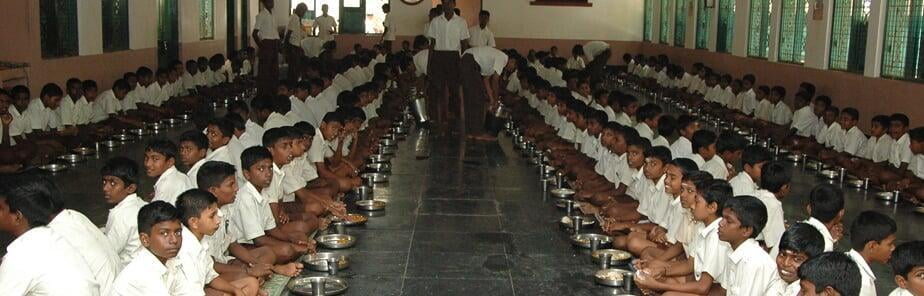

-Annadanam Donations-

The Students' Home collects donations to meet the food expenses of all students. Donors donate on the occasion of special days like birthday, wedding day, in memory of loved ones, festivals, celebrations and others. Sponsorships, Donations are exempted from Income Tax under section 80G of Income Tax Act 1961.

| Menu | Total Rs. |

|---|---|

| Breakfast | 11,000 |

| Lunch [Ordinary] | 15,200 |

| Lunch with Fruits | 18,200 |

| Lunch with Sweets | 20,000 |

| Lunch with Sweets & Fruits | 23,000 |

| Evening Tiffin | 7,000 |

| Dinner [Ordinary] | 11,000 |

| Whole Day Annadanam with Ordinary Lunch | INR 44,200 |

| Whole Day Annadanam including Fruits during Lunch | INR 47,200 |

| Whole Day Annadanam including Sweets during Lunch | INR 49,000 |

| Whole Day Annadanam including Sweets and Fruits during Lunch | INR 52,000 |

- Endowment Donations-

Endowments are created to serve a particular purpose – like Annadanam Endowment, Vidyadanam - Education Endowment or General Purpose Endowment. The donated money will be taken as Endowment principal and deposited in bank FDs and other FDs. The interest accrued from the Endowment investment will be used to meet the expenses of the particular purpose for which the Endowment is created.

The Donors can give a suitable name to the Endowments, normally in memory of someone nearer/dearer to the Donor. The Donor or family members and relatives can add contributions to the endowments anytime.

These donations are eligible for exemption from Income Tax under section 80G of I T Act 1961.

- Vidyadanam - Educational Donation -

The Students' Home needs donations for providing free education to all the students. Giving books, notebooks, other educational aids to students, meeting school and institute laboratory and workshop expenses and related expenses need donations from well wishers. These donations are eligible for exemption from Income Tax under section 80G of Income Tax Act 1961.

We give below the expenses we are going to incur for maintaining and educating an Orphan and Destitute boy in our Home for the year 2024-2025.

| Section | Institute & Extracurricular | Books & Stationary | Uniform 3 Sets | Boarding & Lodging | Total Rupees |

|---|---|---|---|---|---|

| Residential High School Std VI to X | 8,000 | 1,200 | 1,500 | 19,500 | 30,200 |

| Residential Polytechnic College | 20,000 | 3,000 | 1,800 | 22,500 | 47,300 |

| Primary School | 1,500 | - | - | - | 1,500 |

- Capital Donation -

Donations can be given to construct buildings in the Students Home, purchase furniture, laboratory and other equipment, utensils and vehicles for the Students Home and its units - Residential High School, Residential Polytechnic College and Centenary Primary School. These donations are eligible for exemption from Income Tax under section 80G of Income Tax Act 1961.

- Other Needs -

Equipment for the Polytechnic College

- Mechanical Engineering - New or Old Machinery, parts, instruments etc

- Automobile Engineering - New or used vehicles or parts, testing or repairing equipment etc

- Computer Engineering Department - New or used PCs, Laptops and Network devices etc

Donations in kind of consumer items like

- Rice, Pulses, Wheat, Oil, Milk, and other provisions, fruits, sweets

- Uniform dress, Carpets, Mats, Bed sheets, Pillows

- Soaps, Detergents

- Tooth Paste, Tooth Powder, Tooth Brush etc.

- Notebooks, Calculators, Stationery items etc.

- Medicines

- Sports goods like balls, bats etc

Donation Methods

Indian Donors

Donors get Income Tax exemptions u/s 80G for all their Donations \ Endowment Donations.

Please choose any of the following methods to donate:

Direct Bank Transfer / NEFT / RTGS / ECS :

Donations by UPI/VPA:

You can send your donation using our UPI / VPA

rkmshome@hdfcbankThis UPI / VPA id can be used in most of the Mobile Wallets and Digital Payment Apps in India.

After sending the donation, please send the donation details to our email: chennai.studentshome@rkmm.org

Donations by Cheque/DD:

The Secretary,

Ramakrishna Mission Students Home,

No 66, P.S.Sivaswami Salai, Mylapore,

Chennai 600 004.

Phone: 044 - 2499 0264 / 4210 7550

Donations by Net Banking:

Donations by Credit / Debit Cards:

Foreign Donations - All Donations / Endowments

Donations may be sent to the following bank account (SWIFT / Wire Transfer / Net Banking) and the details sent to our address by email: chennai.studentshome@rkmm.org

Bank Account Name | Ramakrishna Mission Students Home |

Bank Account Number | 400 895 10964 |

Bank and Branch | State Bank of India, New Delhi Main Branch (NDMB), Sansad Marg, New Delhi 110001 |

Branch Code | 00691 |

SWIFT CODE | S B I N I N B B 1 0 4 |

IFSC Code | SBIN0000691 |

Our FCRA Registration No: | 075900193 Please quote this no. without fail in your transfer application (SWIFT etc) |

Our name and contact details:

| Ramakrishna Mission Students Home, 66, Sir P S Sivaswami Salai, Mylapore, Chennai 4 Email: Chennai.studentshome@rkmm.org Ph: +91 7010 418 560 |

Currency: | for speedy transfer, you can send foreign currency equivalent to Indian rupees to be donated. |

Once you make the donation through the bank transfer to above mentioned account, please write an email mentioning about the transaction details such as:

1. Purpose of the Donation

2. Donation Amount

3. Your Name

4. Address

5. Date of Transfer and

6. Transaction ID

7. A soft copy your passport

Please email us about your donations to: chennai.studentshome@rkmm.org

WhatsApp: +91 7010 418 560

Donations by Cheque / DD

Cheque / D.D should be drawn in favour of Ramakrishna Mission Students Home and with a covering letter mentioning your name, address, donation details, email address and a copy of your passport may kindly be sent to:

The Secretary

Ramakrishna Mission Students Home

No 66, P.S.Sivaswami Salai, Mylapore

Chennai 600 004, India

Phone: 044 - 2499 0264 / 4210 7550 / 7010418560

Donations by US donors with US Tax Exemption

Donors from the USA can avail 501(c) tax exemptions in the USA by sending their donations to the Students Home through any one of the following two organizations. They are approved tax exempt corporations under Section 501(c)(3) of the U.S.Internal Revenue Service code:

(1) Ramakrishna Foundation

4900, Overland Avenue

#169, Culver City, CA90230-4266, USA.

To contact:

Kaushik Biswas, Treasurer

Ramakrishna Foundation

294 Oakhurst Lane, Unit A

Arcadia, CA 91007

E-mail: (Kaushik Biswas, Treasurer) kaushik@ramakrishnafoundation.

Medical and Educational Foundation,

P.O.Box 4796, Diamond Bar, CA-91765, USA.

Phone: 909-861-0247

E-mail Address: americanservice2india@gmail.

website: http://asti1.com/

Contact Person: Mr. Bakul Zaveri

Please write an email to us after making a donation to any one of the above organizations so that we can follow up with the organization. In case you need further details please contact us.

What is Foreign Donations?

Foreign contribution is any donation, delivery or transfer made by -

a) Persons of Indian Origin (PIO) Card holder / Persons of Indian Origin (PIO) who hold other country passports (or)

registered Overseas Citizens of India (OCI)

b) a foreign citizen, foreign company, foreign government or its agency,

c) any international agencies (other than certain specified agencies such as United Nations, World Bank, etc.),

d) any other foreign entity such as trusts, societies, clubs, trade unions and so on formed or registered outside India. It also covers multi-national corporations and any company where more than 50% of the share capital is held by foreign government, entity or citizen.